Our Approach

Summary

We typically purchase distressed, discounted, vacant houses and small multi-family properties in need of renovation. We focus on stable lower and middle income neighborhoods of Chicago. The areas we focus on have a strong rent to purchase price ratio as compared to higher income areas of Chicago and therefore, allow for stronger net income.

We typically purchase distressed, discounted, vacant houses and small multi-family properties in need of renovation. We focus on stable lower and middle income neighborhoods of Chicago. The areas we focus on have a strong rent to purchase price ratio as compared to higher income areas of Chicago and therefore, allow for stronger net income.

The housing stock in Chicago consists primarily of older properties, near 100 years old, often with solid brick structure, but in need of renovation, updating, and maintenance. By managing the renovation work we ensure the final product will be a solid operating asset without inherent, underlying issues. We have found that properties renovated by others, can often have been completed poorly, with underlying concerns not fully addressed although they may look good on the surface with new drywall, paint and finishes. Such potential issues include: structural, electrical, plumbing, insulation etc. We have dealt with clients that have purchased recently renovated properties that appeared to be good deals prior to purchase, but after we take over managing for a while we encounter a number of underlying issues that become headaches for everyone: owner, property manager, and tenants.

With Paragon overseeing the renovations, you can be confident that shortcuts are not taken and that the goal is on a quality finished product that will operate solidly. As either partner and/or property manager, our goals are aligned.

Why Chicago?

Chicago is a great market for rental real estate investing. It offers an ideal combination of a large, economically diverse global city, with affordable home prices and a good price-to-rent ratio.

Chicago is a great market for rental real estate investing. It offers an ideal combination of a large, economically diverse global city, with affordable home prices and a good price-to-rent ratio.

Chicago is considered the 7th most expensive American city in terms of rent, which is beneficial for a property owner earning rental income. And rental prices in Chicago have been constantly growing in the last 10 years and there are grounds to assume the trend will gain momentum.

What’s more, it is the third most populous city in the US, trailing only New York and Los Angeles (Chicago is home to 2.7M people). In addition, the city has a lot of appeal, and is even believed by some to be the most beautiful city in the country.

Looking further and the price-to-rent ratio – When investing in rental property it is important to look at the price-to-rent ratio of the city and area that you will be investing in. Ideally you want a location that has a lower price to rent ratio, that way you can purchase rental property to rent out for strong rental income. In comparing price to rent ratios, we see that Chicago has a more favorable price-to-rent ratio (for investors) than other major cities in the US. Refer to the table below:

| City | Price-to-Rent Ratio | Home Price for a $1,000 Rental |

|---|---|---|

| San Francisco, CA | 45.9 | $550,560 |

| Los Angeles, CA | 38.0 | $456,240 |

| New York, NY | 35.6 | $427,800 |

| Seattle, WA | 35.1 | $421,080 |

| Boston, MA | 28.7 | $344,280 |

| Chicago, IL | 21.6 | $259,200 |

| Phoenix, AZ | 20.3 | $243,600 |

| Houston, TX | 15.3 | $183,480 |

Data excerpted from: https://smartasset.com/mortgage/price-to-rent-ratio-in-us-cities

Rental Demand

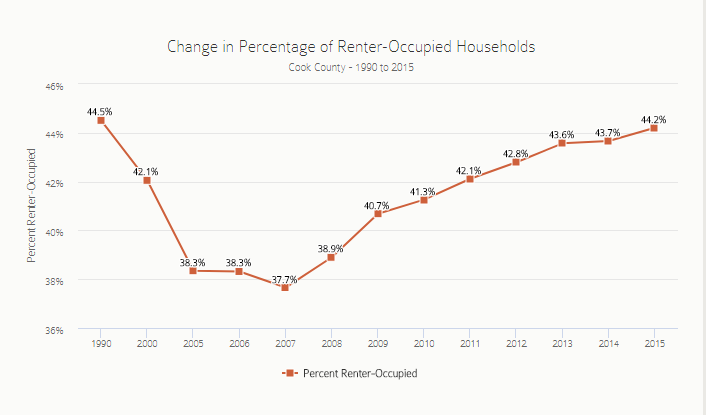

Source: Institute for Housing Studies at DePaul University – 2017 State of Rental Housing in Cook County

According to the Institute for Housing Studies at DePaul University’s report “2017 State of Rental Housing in Cook County” Cook county’s rental rate is at its highest level since 1990. Note that Cook County is the county where Chicago is located. Since 2007, the rental rate in Cook County has steadily increased as a result of declining demand for home ownership and a shifting preference for rental housing.

Furthermore, the report identifies that demand for affordable rental housing is at an all time high. The attribute this growth to a decreasing stock of housing units affordable to lower-income people as the real estate market continues to mend.

They also note that Cook County’s stock of rental units in two to four unit buildings has been declining primarily due to foreclosure-associated deterioration and vacancy.

Therefore our approach of focusing on distressed 2-4 unit rental buildings to generate affordable rental housing is positioned will to benefit from these specific trends.

Finding Deals

We find our deals through a number of methods. Our licensed real estate brokers identify foreclosed, bank-owned properties, we place bids via online property auction sites, and we receive deal opportunities from our network of agents and off-market wholesale dealers. Also, we buy houses from distressed owners seeking a quick sale that we identify through our direct marketing approaches such as direct mail and online.

Management

A key aspect of a successful long term real estate investment is solid management. We manage properties in Chicago under our business Paragon Property Management Group LLC. After developing our knowledge, processes, and management infrastructure for over a decade, we are able to maximize the value of operating investment assets for our partners and clients.

Other information on Chicago:

Chicago Ranked Among World’s Most Competitive Cities for Business in New IBM Report

What Is the World’s Most Economically Powerful City?