Invest

Why Invest in Real Estate?

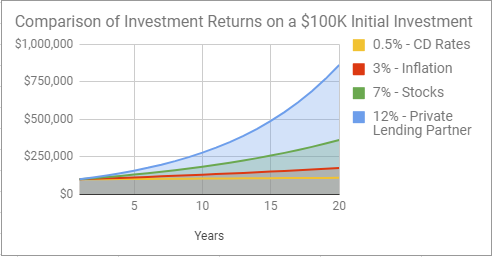

It is generally understood that the average stock market rate of return over time is around 7%. However, according to this article from Forbes, the annualized rate of return for the average investor in a blend of equities and fixed-income mutual funds is just 1.9%! Considering that the average rate of inflation is over 3%, its easy to see why so many of us struggle to find our way to a comfortable retirement using traditional investment methods.

Being able to invest at a higher rate of return, such as 12% will yield nearly 4 times the results after 20 years when you factor in the effect of 3% inflation.

Refer to the chart to the right for a comparison of the investment returns for a variety of investment options. Note that stock returns for the chart are based on a long term average over many years, as stock returns have high volatility. Lower rate returns such as stock and bonds are diminished by nearly 50% due to the effect of inflation. The private lending partner return of 12% is provided as a fixed rate over a period of one year, similar to a bank CD, except at 24 times the return. The short term and fixed rate provide significant advantages over stock returns. Furthermore, the private lender investment is backed and secured by actual real estate.

The ultra wealthy gain significant advantage over the average investor by investing for higher than average returns with investments in real estate and businesses. We can provide this opportunity for you.

Besides the advantage of higher potential returns, there is a reduction in risk to your overall investment portfolio when you diversify out of just the traditional stocks and bonds.

Investing in real estate has proven to be one of the best wealth creators for centuries. One positive about the asset class of real estate is that it is a basic necessity of life. People will always need a home and will always rent or own a property. Unlike stocks and bonds, real estate is a tangible asset– it cannot disappear overnight like the potential stock value of a company. The benefit of a cash flowing rental property it can provide the benefit of a stock that pays you a dividend, as rent comes in monthly. Furthermore, real estate historically appreciates over time, thus creating wealth for yourself and your family. By leveraging your investment with low interest rate real estate loans you can enjoy significant rates of return.

Why Invest with Paragon?

The Paragon team has been involved in Chicago real estate investment and management for over a decade, and has been providing real estate services to investors all over the world for several years. We specialize in Chicago real estate investing and we have the experience, specialized knowledge, and systems to generate strong returns with well managed risk. By partnering with us, you are free to focus on your job, your area of expertise, and benefit from us performing in our area of expertise.

Not only do we identify, acquire, and renovate the properties, we also perform long term management, providing a fully integrated service with total accountability. Through our economies of scale and efficient processes, you can enjoy your investment returns and leave the work to us.

Over the course of the past 2 years, we paid out approximately $60K in profits to our lending partners on approximately $800K of project funds.

How You Can Participate – Options:

Private Lender

Fixed Rate of Return- Investment secured by Mortgage in first lein position as well as Promissory Note

- Investment time frame 6-12 months

- Minimum investment $30K

- Listed as additional insured on property insurance policy

- Earn high fixed return. All project risk handled by Paragon

IRA Lender

Fixed Rate of Return- Apply IRA funds to a plan administrator that services self-directed retirement plans.

- Use your IRA to provide a project loan, secured by Mortgage in first lien position as well as Promissory Note

- Investment time frame 6-12 months

- Earn high rate of return tax-deferred in IRA

- Minimum investment $30K

The table above does not imply an offering of securities and is for discussion purposes only.